what does nypfl mean on w2 - are fmla benefits taxable : 2024-10-31 what does nypfl mean on w2NYPFL stands for New York Paid Family Leave, a tax paid by New York residents or workers. Learn how to report it on your W-2 form, how it affects your federal and state taxes, and how to avoid double taxation if you live in another state. See more what does nypfl mean on w2$620.00. Sizes Currently selected. Size guide. 80 CM. 90 CM. 100 CM. Find a Store Near You. Product details. Delivery & Returns. Gifting. The iconic LV Circle 35mm reversible belt makes an eloquent signature statement with its buckle in the form of the LV Initials inside a delicate circle, a symbol of timeless perfection.

In this detailed exploration of cannabis cultivation, you will find the essential practices of growing cannabis and nurturing marijuana plants, shedding light on the pivotal role of cloning in maintaining genetic integrity and optimizing harvests.

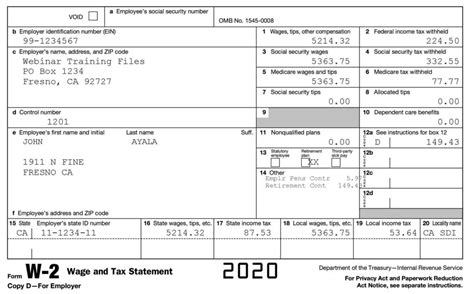

what does nypfl mean on w2Yes, if you are ill and the employer pays you for it, it is considered under PFL, or Paid Family leave. For example: You have chemotherapy, or you get leave due to . See moreN-17-12 is a form that shows your taxable benefits under New York State's Paid Family Leave program. W-2 Box 14 is where your employer reports your premium contributions . NYPFL and NYSDI are amounts that are deducted from your pay each period. These deductions may be deductible as a state and local tax if you itemize your deductions on Schedule A (Itemized .

what does nypfl mean on w2 No. NYPFL in Box 14 of your W-2 should be listed under the category of Other deductible state or local tax when you are entering your W-2 on the federal screen. If .

How PFL is Funded. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Each year, the Department of Financial Services sets the .Employers should report employee PFL contributions on Form W-2 using Box 14 — "State disability insurance taxes withheld." — Reporting of PFL benefits . PFL benefits are .The State’s new Paid Family Leave program has taximplications for New York employees, employers, and insurance carriers, including self-insured employers, employer plans, .

GTA SAN ANDREAS : LSPD VS SFPD VS LVPD (BEST COP CAR?) Onespot Gaming. 3.47M subscribers. Subscribed. 1. 2. 3. 4. 5. 6. 7. 8. 9. 0. 1. 2. 3. 4. 5. 6. 7. 8. 9. 0. 1. 2. 3. 4. 5. 6. 7. 8. 9. K..

what does nypfl mean on w2