notify ato moving overseas - tax return when leaving australia : 2024-10-30 notify ato moving overseasAs I understand it I must notify the ATO when I move overseas via a form that . notify ato moving overseasJa nodokļu maksātājs vēlas noskaidrot informāciju par samaksāto nekustamā īpašuma nodokli, vai iespējamo parādu u.c. gadījumos, jāsazinās ar pašvaldību, informācija pieejama arī tīmekļvietnē www.epakalpojumi.lv. Pakalpojuma pieprasīšanai nepieciešamie dokumenti: - iesniegums brīvā formā; - nekustamā īpašuma .

Flangesize 40 Length S M Winding LV LV Motor Nominal voltage [VDC] 360 360 Nominalcurrent [A] 0.7 1.2 Continuouscurrentatstandstill [A] 0.8 1.6 Peakcurrent [A] 3.2 6.4 Ratedoutput [W] 110 200 Nominal torque [Nm] 0.12 0.21 Peak torque [Nm] 0.7 1.4 Torqueatstandstill [Nm] 0.18 0.35 Nominalrotationalspeed [rpm] 9,000 9,000 .

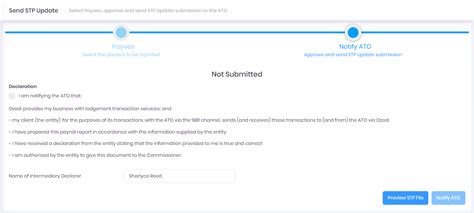

notify ato moving overseasTo notify us, complete an overseas travel notification and update your contact .If you're leaving Australia to live overseas, find out about the tax-free threshold and .If you're leaving Australia to live overseas, find out about the tax-free threshold and how it applies to you. Certificate of residency and overseas tax relief form Request a certificate . As I understand it I must notify the ATO when I move overseas via a form that should be accessible on the Tax module within MyGov. This is not the case so I . To notify us, complete an overseas travel notification and update your contact details, including your mobile, international residential, postal and email . When you move overseas you can let us know your residency status has changed by submitting a tax return. You can submit an early tax return if you meet some .There's no need to notify us that you're moving! You might still have some tax obligations here though, depending on your circumstances. We have information on our website .

What to do before you travel or move overseas. How your plans may affect your payments, concession cards, health care and child support.Steps to Notify the ATO. Determine your tax residency and be clear on your tax obligations. Submit the tax return in the year when you left and update ATO on the date . Hey, I've been living overseas since 2012 and am now trying to declare my worldwide income for the 2016/17 tax year, in line with the new HECS repayment rules. However, in myGov, I can only see the option to submit an overseas travel notification for upcoming or recent departures from Australia. MyGov and the overseas travel .

notify ato moving overseasI recieve the Australian Aged Pension and moving to UK permantly. I dont wont to be taxed twice. I would like to be taxed on all my Australian and UK pensions and bank accounts only in the UK as a British Citizen. How do I notify Australia ATO not to tax me as a non resident, on my Australian Pension. Also how do i go about notify ATO that I will be tax .

Kas ir ECC Latvia? Patērētāju apkalpošanas standarts. Eiropas patērētāju centru tīkls (turpmāk – ECC-Net) apvieno 30 centrus Eiropas Savienības dalībvalstīs, kā arī Norvēģijā un Islandē, kas sadarbojas, lai atrisinātu patērētāju sūdzības. Katru centru līdzfinansē Eiropas Komisija un valstu valdības.

notify ato moving overseas